Sustainability

Environment

Achieving a decarbonized society

Initiatives for Task Force on Climate-Related

Financial Disclosures (TCFD)

We position our efforts to address climate change as essential both for our own business development and for the sake of a sustainable society. Therefore, in FY 2022, we endorsed the TCFD’s recommendations to assess and disclose the financial impact of climate change-related risks and opportunities on our management, and we will take an active role in the climate change initiative to disclose this information.

Governance

Supervision of climate change-related issues by the Board of DirectorsKyoritsu Maintenance Group has integrated climate change into its governance process, in which the Board of Directors, as the governing body for risk management, is involved in the process of managing climate change-related risks and opportunities. The Sustainability Promotion Committee, which is subordinate to the Board of Directors, plans, deliberates, and make decisions on climate change-related matters and manages and governs the initiatives to address climate change.

Decision-making of climate change-related issuesThe President receives reports from the Sustainability Promotion Committee on climate change-related issues, and as the chief executive, makes decisions (confirm and approve) on specific measures and target management of climate change-related risks and opportunities, and reports to the Board of Directors twice a year.

Strategies

The Group conducted scenario analyses for its three main segments of the Dormitory Business, the Hotel Business, and the Senior Life Business in response to the high uncertainty surrounding the future in transitioning to a decarbonized society, under scenarios of less than 1.5°C and 4°C global warming compared to pre-industrial levels. For definitions of anticipated time frame, Short-term is until 2026, Mediumterm until 2030, and Long-term until 2050; for scale of financial impact, 1.5 billion yen or more is Large, 500 million yen to less than 1.5 billion yen is Medium, and less than 500 million yen is Small.

Risks and Opportunities in the 1.5°C Scenario

| Perspective | Expected Events | Risks | Opportunities | Expected Financial Impact | Businesses Affected | Anticipated Time Frame & Scale of Financial Impact | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dorm | Inn | Resort | Senior | Short- Term | Medium- Term | Long- Term | |||||

| Policy/legal regulations | Taxation on greenhouse gas emissions such as carbon taxes | Carbon tax levied according to greenhouse gas emissions (Scopes 1 and 2) | ー | Medium | Large | ||||||

| Rising prices for food, amenities, and equipment due to carbon taxes on business partners | ー | Small | Medium | ||||||||

| Tighter regulations on food waste | Reviewed cooking methods and new investments to reduce waste | ー | Small | Medium | |||||||

| Tighter regulations on plastic waste | Promote reuse and reduction of plastic to mitigate impact from regulations | ー | Small | Medium | |||||||

| Technology | Improved production efficiency of renewable energy | Lower renewable energy prices make reducing carbon tax burden easier | ー | Small | Medium | ||||||

| Improved efficiency of energy-saving equipment | Equipment efficiency improvements may lead to both efficiency gains through replacements and stranded assets from replacing existing products | ー | Small | Medium | |||||||

| Market | Shift in customer values due to growing climate crisis awareness and concerns | Greenhouse gas emission reduction efforts appeal to customers choosing residences | Small | Small | Medium | ||||||

| Reputation | Increased climate change concerns among investors and job applicants | Climate change response affects stock prices and recruitment efforts | Small | Medium | Medium | ||||||

Risks and Opportunities in the 4°C Scenario

| Perspective | Expected Events | Risks | Opportunities | Expected Financial Impact | Businesses Affected | Anticipated Time Frame & Scale of Financial Impact | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dorm | Inn | Resort | Senior | Short- Term | Medium- Term | Long- Term | |||||

| Acute | Increased frequency and expanded damage from typhoons, torrential rain, and accompanying floods and landslides | Facility damage leading to repair costs | (*) | Small | Small | Medium | |||||

| Facility damage leading to business suspension | (*) | Small | Small | Medium | |||||||

| Supply chain disruptions due to traffic blockages preventing food and materials from being delivered, resulting in business suspension | (*) | Small | Small | Medium | |||||||

| Traffic blockages preventing employees from commuting, resulting in business suspension | Small | Small | Medium | ||||||||

| Chronic | Rising average temperature due to global warming | Increased risk of heatstroke for customers, leading to behavioral changes and poorer health | ー | Small | Medium | ||||||

| Increased risk of heatstroke for employees, leading to changes in commuting and working styles | ー | Small | Medium | ||||||||

| Increased air conditioning costs | ー | Small | Medium | ||||||||

Risk Management

Identification & evaluationThe Group recognizes that climate change is an important issue for the survival of corporations and believes that responding appropriately to climate change, not only in terms of risks but also opportunities, will lead to sustainable growth.

The Sustainability Promotion Committee, which is delegated by the Board of Directors, discusses the identified risks and opportunities, and comprehensively evaluates the challenges facing the Group and impacts on the Group’s management in terms of both financial impact and likelihood of occurrence to determine the priorities. Business risks and opportunities are identified by comprehensively considering factors such as challenges facing the Group, requests and expectations of stakeholders, and results of environmental impact assessments, then are managed and addressed in future management plans.

ManagementThe Sustainability Promotion Committee, in response to the requests from the Board of Directors, discusses and approves various policies, targets, and measures related to sustainability, and reports to the Board of Directors.

ProcessThe Group believes that it is important to consider climate change from the perspectives of both risks and opportunities. To this end, we not only monitor climate change risks but also evaluate opportunities by strengthening collaboration with relevant departments and Group companies. Instructions are given to relevant departments after issues are deliberated and approved by the Sustainability Promotion Committee and reported to the Board of Directors.

Indicators and Targets

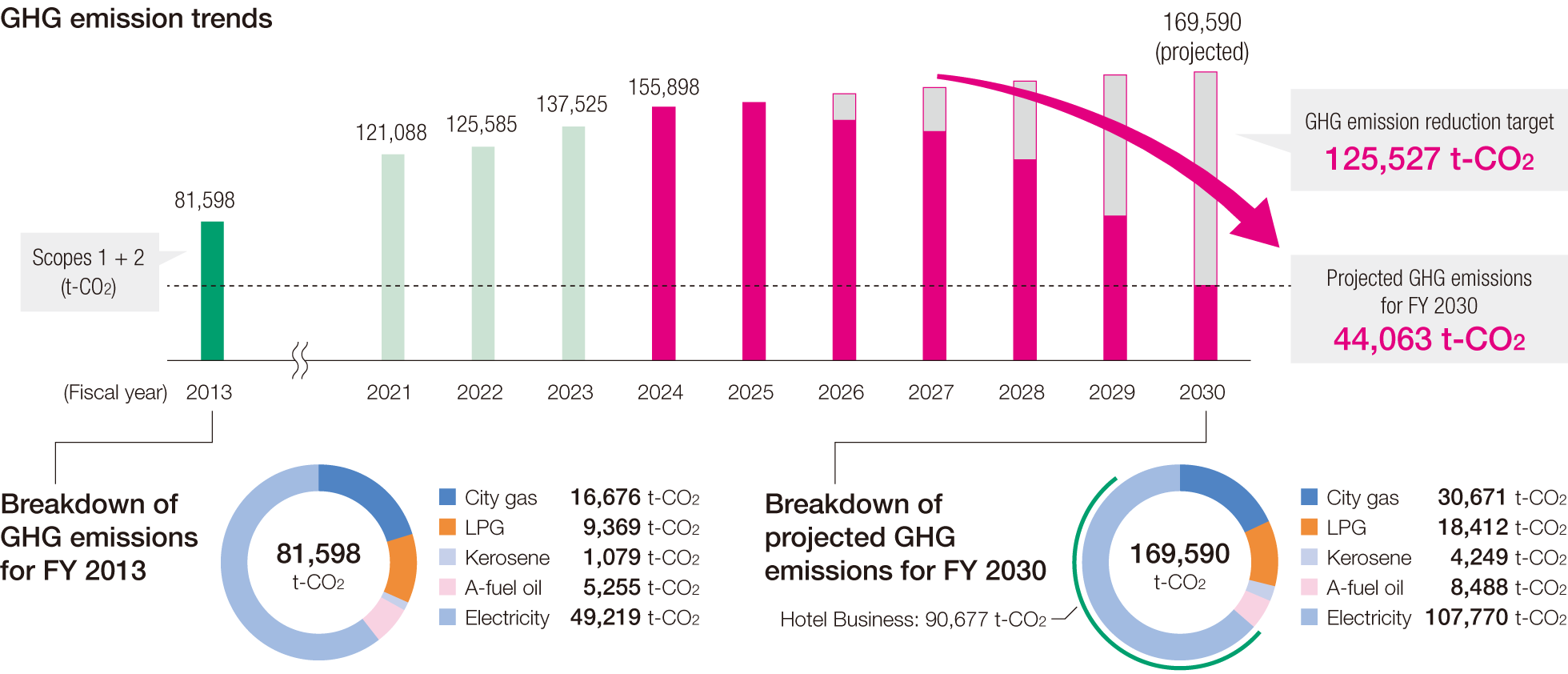

The Group aims to reduce greenhouse gas (Scopes 1 and 2) emissions by FY 2030 by 46% compared to FY 2013.

| Indicator | Description |

|---|---|

| Scope 1 emissions | GHG emissions from fuel (city gas, LPG, kerosene, A-fuel oil) used by the Company (*) Usage is based on actual results; emission intensity is based on the “Accounting Methods and List of Emission Factors under the Mandatory GHG Accounting and Reporting System” by the Ministry of the Environment |

| Scope 2 emissions (market-based) |

GHG emissions from electricity and other energy used by the Company (*) Usage is based on actual results; emission intensity is based on the “List of Emission Factors by Electric Power Supplier” and the “Accounting Methods and List of Emission Factors under the Mandatory GHG Accounting and Reporting System” by the Ministry of the Environment |

Reduction Plan

Scope 1

We will promote efficient energy use at each facility and transition to energy-efficient equipment.

Scope 2

(Electricity)

From FY 2026 onward, we will gradually switch to the procurement of power derived from renewable energy sources and acquisition of environmental value through non-fossil fuel certificates, focusing primarily on facilities that use large amounts of electricity and receive high-voltage power.

Global Warming

Countermeasures Report