Sustainability

Governance

Directors

Board of Directors and Committee Overview

| Number of sessions per year | Overview | |

|---|---|---|

| Board of Directors | 12 | The Board of Directors meets regularly once a month for a total of 12 times per year based on the Board of Directors Rules and also holds extraordinary board meetings as necessary to report, deliberate, and make decisions on matters stipulated by laws and regulations as well as the Articles of Incorporation. |

| Audit and Supervisory Committee | 12 | The Audit and Supervisory Committee meets at least once a month based on the Audit and Supervisory Committee Rules and also holds ad hoc meetings as necessary to audit the performance of duties by the Board of Directors, create audit reports, and perform other duties stipulated by laws and regulations and the Articles of Incorporation based on the Audit and Supervisory Committee Auditing Standards. |

| Nominating Committee | 3 | The Nominating Committee has been established to strengthen the fairness, transparency, and objectivity of procedures related to the nomination of Directors and to enhance corporate governance at the Company. Specifically, the committee conducts interviews with candidates for Directors and deliberates the appropriateness of the selection reasons and capabilities of individual candidates in light of the Company’s director appointment policy. The committee also deliberates on matters such as succession plans and skills matrix of the Board of Directors. |

| Remuneration Committee | 4 | The Remuneration Committee has been established to strengthen the fairness, transparency, and objectivity of procedures related to director compensation and to enhance corporate governance at the Company. Specifically, the committee deliberates on individual director compensation, including basic compensation, director bonuses, and non-monetary compensation (stock compensation) related to restricted stock. |

Director Remuneration

Basic policy Our basic policy for remuneration for the Company’s Directors (excluding Outside Directors and Directors who are Audit and Supervisory Committee Members) is to maintain a remuneration system designed to function sufficiently as an incentive to continuously improve corporate value and to ensure appropriate remuneration based on the individual Director’s job responsibilities when determining their remuneration.

Composition of director remunerationDirector remuneration is comprised of a basic remuneration paid monthly, a director bonus paid at a certain time each year, and restricted share-based remuneration. The basic remuneration is comprised of a rank-based salary and a position-based salary based on their position and tenure as well as their contribution to business, and a performance-based salary determined according to their individual evaluation. Director bonuses are performance-linked remuneration, with individual net income for the period used as the main indicator. The reason we adopted this indicator is because it indicates final performance figures for the fiscal year in question, and as such, we found it to be the most reasonable standard for the basis of calculating performance-linked remuneration. Restricted share-based remuneration is given in accordance with each Director’s position and tenure, etc. from the perspective of providing incentive regarding improving long-term corporate value.

Remuneration for Outside Directors and Directors who are Audit and Supervisory Committee Members is comprised of a basic remuneration paid monthly and is fixed to maintain objectivity and fairness.

| Types of remuneration | Calculation method |

|---|---|

| Basic remuneration | Individual evaluation of business performance, contribution to company management, etc. |

| Performance-linked remuneration (bonuses) | Individual net income for the period used as an indicator |

| Restricted share-based remuneration | Granted according to position and tenure |

| Director category | Total remuneration (Millions of yen) |

Total remuneration by type (Millions of yen) | Number of eligible Directors | ||||

|---|---|---|---|---|---|---|---|

| Basic remuneration | Performance-linked remuneration | Retirement benefits | Restricted share-based remuneration | Of which, non-monetary remuneration | |||

| Directors (excluding Audit and Supervisory Committee Members and Outside Directors) |

963 | 266 | 640 | ― | 56 | 56 | 11 |

| Directors (Audit and Supervisory Committee Members, excluding Outside Directors) |

11 | 11 | ― | ― | ― | ― | 1 |

| Outside Directors | 31 | 31 | ― | ― | ― | ― | 6 |

Determination process for director remunerationThe policy on determining the details of individual remuneration, etc. for Directors of the Company is determined by a resolution of the Board of Directors after consulting the Remuneration Committee, of which the majority are independent Outside Directors, prior to the Board of Directors meeting. Based on the policy for determining individual remuneration, etc. for Directors, the Remuneration Committee carefully deliberates on and determines individual remuneration, etc. for Directors (excluding Directors who are Audit and Supervisory Committee Members) in consideration of company performance and other indicators within the range of the total remuneration resolved at the General Meeting of Shareholders. Remuneration for Directors who are Audit and Supervisory Committee Members is determined by a deliberation by Directors who are Audit and Supervisory Committee Members within the range of the total remuneration resolved at the General Meeting of Shareholders.

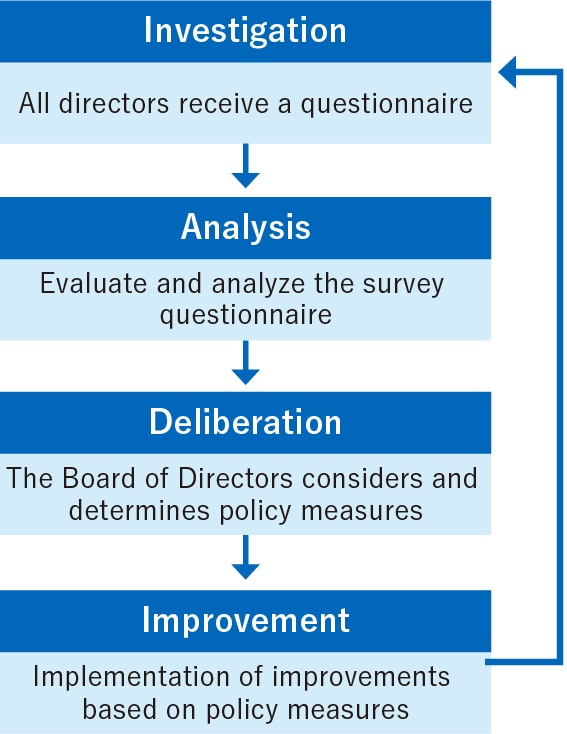

Effectiveness Assessment

The Company conducts an analysis and assessment of the effectiveness of the Board of Directors as a whole (Board of Directors Effectiveness Assessment) once a year from the end of March to May, the end of our fiscal year, in order to further improve the composition and operation of the Board of Directors in the future.

For the analysis and assessment method, all Directors complete an anonymous self-assessment questionnaire that references information from other companies and external insight. The content of the analysis and assessment is reviewed by the Board of Directors once responses are received from all participants.

In the analysis and assessment for FY 2024, the composition, size, and operation of the Board of Directors, cooperation with auditing organizations, and relations with shareholders and investors were assessed positively, and that a governance structure similar to that of FY 2023 was being maintained, leading to the analysis and assessment that the Company’s Board of Directors is fulfilling the role expected of it in an appropriate manner and has ensured sufficient Board effectiveness.

In light of expectations for a revision of standards for agenda to be submitted to the Board of Directors, we will take a focused and detailed approach in exploring these suggestions as we continue to work to increase the effectiveness of the Board of Directors.

Director Training

In addition to having newly appointed Directors, including Audit and Supervisory Committee Members, undergo external training in order to enhance their knowledge, the Company also provides opportunities for knowledge acquisition after they have been appointed, such as by holding study meetings with external specialists to address revisions to laws.

In order to ensure that the necessary knowledge is acquired by each operations division, the Company encourages appropriate participation in various external seminars, etc.

Succession Plan

The Company has established the “Basic Policy on Company President Succession Plan.”

In the selection of the President’s successor, the Representative Directors will recommend a candidate to the Board of Directors at an appropriate time from among the successor candidates who have been developed over the medium to long term. The Board of Directors will then consult the Nominating Committee regarding the recommended candidate. The Nominating Committee, primarily composed of Outside Directors, engages in thorough discussions by incorporating independent perspectives, broad viewpoints, and managerial insights from Outside Directors with management experience, and submits its findings and recommendations to the Board of Directors. The Board of Directors, upon receiving the recommendations from the Nominating Committee, conducts final discussions and makes the decision on the appointment of the President.

In FY 2024, the progress of the succession plan and future initiatives based on the Basic Policy were discussed by the Board of Directors following deliberations by the Nominating Committee, which is primarily composed of Outside Directors.

[Selection Process]

-

1

Selection of successor candidates

- Multiple successor candidates are selected from among individuals who are capable of practicing the Company’s management philosophy and possess extensive knowledge and experience, regardless of nationality, race, gender, career history, or age.

-

2

Development of candidates

- Development plans are formulated for the multiple successor candidates to allow them to gain experience in challenging operations on the ground and management on a daily basis, both within the Company and at Group companies, so that they are systematically developed over an adequate period of time with the necessary resources.

-

3

Narrowing down of final candidates

- The Representative Directors recommend a candidate to the Board of Directors at an appropriate time from among the successor candidates who have been developed over the medium to long term. The Board of Directors then consults the Nominating Committee regarding the recommended candidate.

-

4

Evaluation by the Nominating Committee

- The Nominating Committee engages in thorough discussions by incorporating independent perspectives, broad viewpoints, and managerial insights before submitting its findings and recommendations to the Board of Directors.

-

5

Decision by the Board of Directors

- The Board of Directors, upon receiving the recommendations from the Nominating Committee, conducts final discussions and makes the decision on the appointment of the President.

Cross-Shareholdings

Policy on cross-shareholdingsThe Company holds shares of some of its clients as cross-shareholdings with the objective of strengthening business relationships.

The Corporate Planning Division and departments that supervise transactions make judgments on whether to hold the shares of such companies based on their current and future levels of profitability, etc., and from the perspective of whether strengthening relationships with the companies will help maintain and increase the corporate value of the Company.

Verification of cross-shareholdingsFor shares of clients held by the Company, once a year the Corporate Planning Division validates the status of the shareholding with the departments that supervise transactions by considering the economic rationale, which includes the original objective of holding the shares, the status of the business relationship such as transaction amounts and the nature of the business, and the cost of capital.

The Company seeks to reduce shareholdings that are found, as a result of this process, to no longer match the original objective for holding shares by selling them or taking other steps.

The details of this verification are reported to the Board of Directors every year.

Moreover, for shares of clients held by the Company as of March 31, 2025, as a result of verifying the objective and reasonability of the holdings, the Company has decided to maintain holdings of all 12 listed stocks.